The 8-Second Trick For Clark Wealth Partners

Table of ContentsAbout Clark Wealth PartnersClark Wealth Partners Can Be Fun For AnyoneSome Known Details About Clark Wealth Partners The Buzz on Clark Wealth PartnersUnknown Facts About Clark Wealth PartnersClark Wealth Partners - QuestionsLittle Known Questions About Clark Wealth Partners.

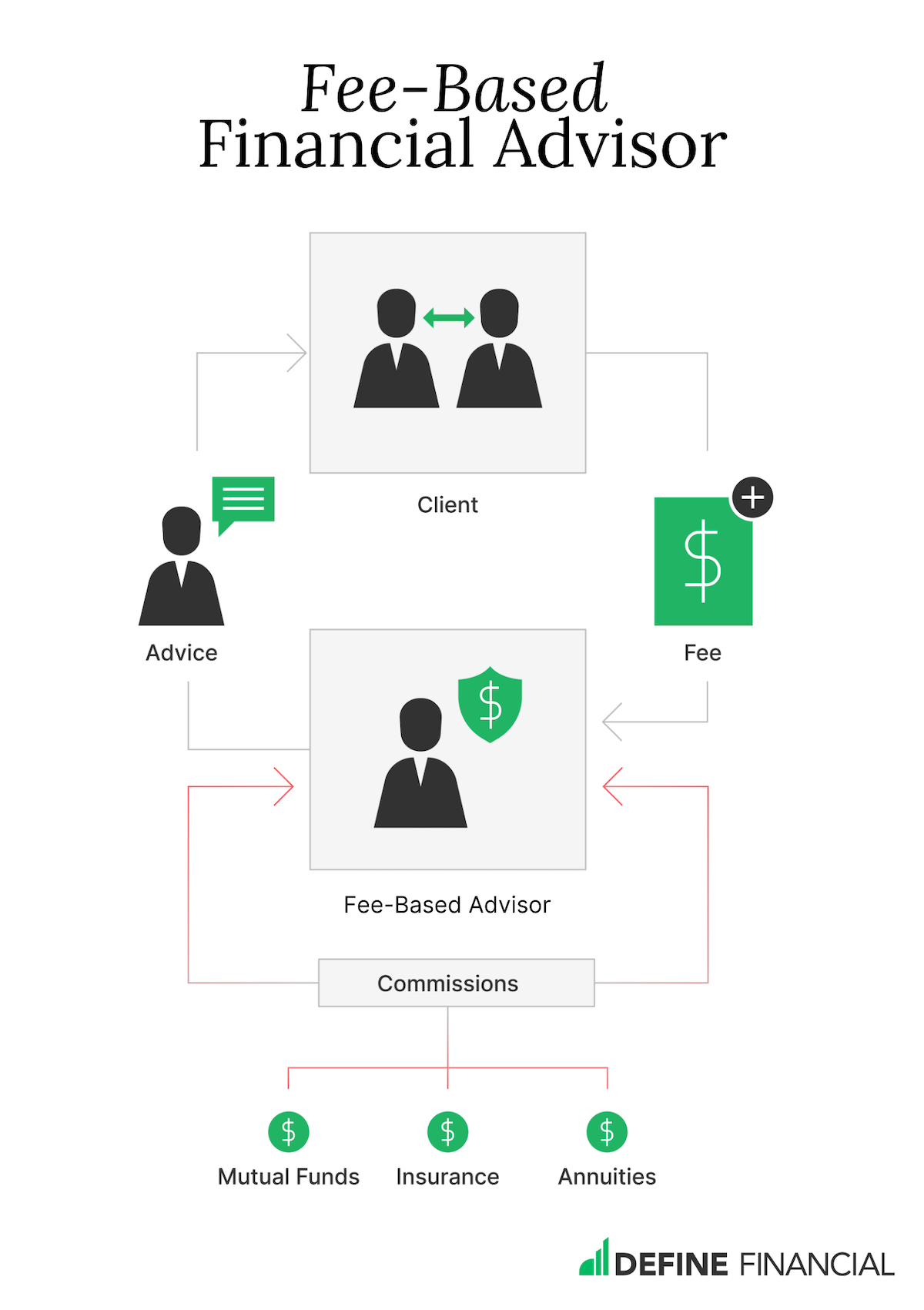

These are specialists that supply investment advice and are signed up with the SEC or their state's safeties regulatory authority. NSSAs can assist senior citizens choose concerning their Social Security advantages. Financial experts can likewise specialize, such as in trainee loans, elderly demands, taxes, insurance policy and various other elements of your financial resources. The qualifications needed for these specialties can differ.Just financial experts whose classification needs a fiduciary dutylike certified economic planners, for instancecan claim the exact same. This difference additionally suggests that fiduciary and economic consultant fee frameworks vary also.

Getting My Clark Wealth Partners To Work

If they are fee-only, they're extra likely to be a fiduciary. Many credentials and designations require a fiduciary duty.

:max_bytes(150000):strip_icc()/financial-advisor-career-information-526017_final-9c1362c7706146ada8c9173002ddee69.png)

Picking a fiduciary will certainly guarantee you aren't guided towards specific investments because of the compensation they supply - retirement planning scott afb il. With lots of money on the line, you might want a monetary expert that is legitimately bound to utilize those funds thoroughly and just in your best interests. Non-fiduciaries may advise financial investment products that are best for their pocketbooks and not your investing objectives

Clark Wealth Partners Fundamentals Explained

Read extra now on just how to keep your life and savings in equilibrium. Increase in financial savings the ordinary family saw that collaborated with a monetary expert for 15 years or more contrasted to a similar home without an economic expert. Resource: Claude Montmarquette & Alexandre Prud'homme, 2020. "A lot more on the Worth of Financial Advisors," CIRANO Project Information 2020rp-04, CIRANO.

Financial guidance can be useful at transforming points in your life. Like when you're starting a household, being retrenched, intending for retired life or handling an inheritance. When you consult with an advisor for the very first time, work out what you intend to obtain from the guidance. Prior to they make any suggestions, a consultant needs to take the time to discuss what is very important to you.

Get This Report on Clark Wealth Partners

Once you have actually concurred to go in advance, your economic consultant will certainly prepare a monetary strategy for you. You must constantly really feel comfortable with your advisor and their recommendations.

Urge that you are notified of all purchases, which you obtain all communication associated to the account. Your adviser may recommend a taken care of discretionary account (MDA) as a method of handling your investments. This involves signing an agreement (MDA contract) so they can get or sell financial investments without needing to contact you.

Clark Wealth Partners Can Be Fun For Everyone

To safeguard your cash: Don't offer your adviser power of attorney. Insist all document regarding your financial investments are sent out to you, not simply your advisor.

If you're relocating to a new consultant, you'll need to set up to transfer your financial records to them. If you need assistance, ask your consultant to discuss the process.

will certainly retire over the next decade. To look what i found fill their footwear, the country will certainly require even more than 100,000 brand-new economic advisors to enter the market. In their everyday work, financial experts handle both technical and creative jobs. United State Information and Globe Record rated the duty amongst the leading 20 Finest Organization Jobs.

Clark Wealth Partners Can Be Fun For Anyone

Assisting people achieve their economic objectives is a monetary expert's primary feature. Yet they are also a local business owner, and a section of their time is devoted to handling their branch workplace. As the leader of their technique, Edward Jones financial advisors need the management abilities to work with and handle team, in addition to business acumen to produce and carry out a company strategy.

Financial experts invest a long time daily enjoying or checking out market news on television, online, or in profession publications. Financial advisors with Edward Jones have the benefit of office study groups that assist them keep up to date on stock recommendations, mutual fund monitoring, and extra. Spending is not a "set it and forget it" task.

Financial consultants must set up time each week to fulfill new people and catch up with the individuals in their sphere. Edward Jones economic experts are lucky the home office does the hefty training for them.

The Only Guide for Clark Wealth Partners

Edward Jones financial consultants are encouraged to pursue extra training to expand their knowledge and skills. It's likewise a great idea for monetary experts to attend market conferences.